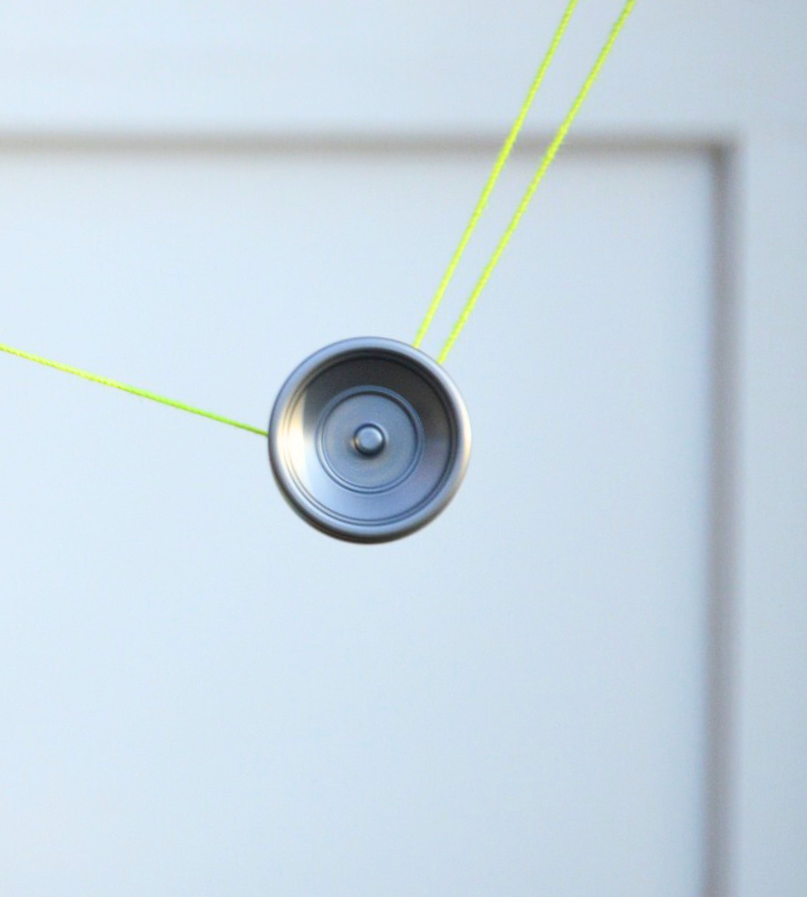

Your credit score is one of your most valuable assets. But what happens when your credit score starts yo-yoing up and down each month without you doing anything? There are several reasons why your credit score could be fluctuating. So, let's dive in and find out why credit scores mysteriously change.

1. You have made late payments

If you’re struggling to make your payments, consider reaching out to find out what hardship assistance is available. A two-minute awkward phone call is well worth it to potentially dodge a hit to your credit file.

2. There could be errors on your credit report

3. Your credit report has been updated

4. You’ve been a victim of identity theft

5. Someone else might be affecting your score

Stay on top of your credit scores

Get tips on how to improve your credit scores.

Disclaimer: This article contains general information only, and is not general advice or personal advice. Wisr Services does not recommend any product or service discussed in this article. You must get your own financial, taxation, or legal advice, and understand any risks before considering whether a product or service discussed in this article may be appropriate for you. We have taken reasonable efforts to ensure that the information is accurate at the time of publishing, but the information is subject to change. We may not update the article to reflect any change.